Hourly to monthly gross income calculator

Maryland Hourly Paycheck Calculator. Does Missouri have state and local income tax.

Salary To Hourly Salary Converter Salary Hour Calculators

Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions.

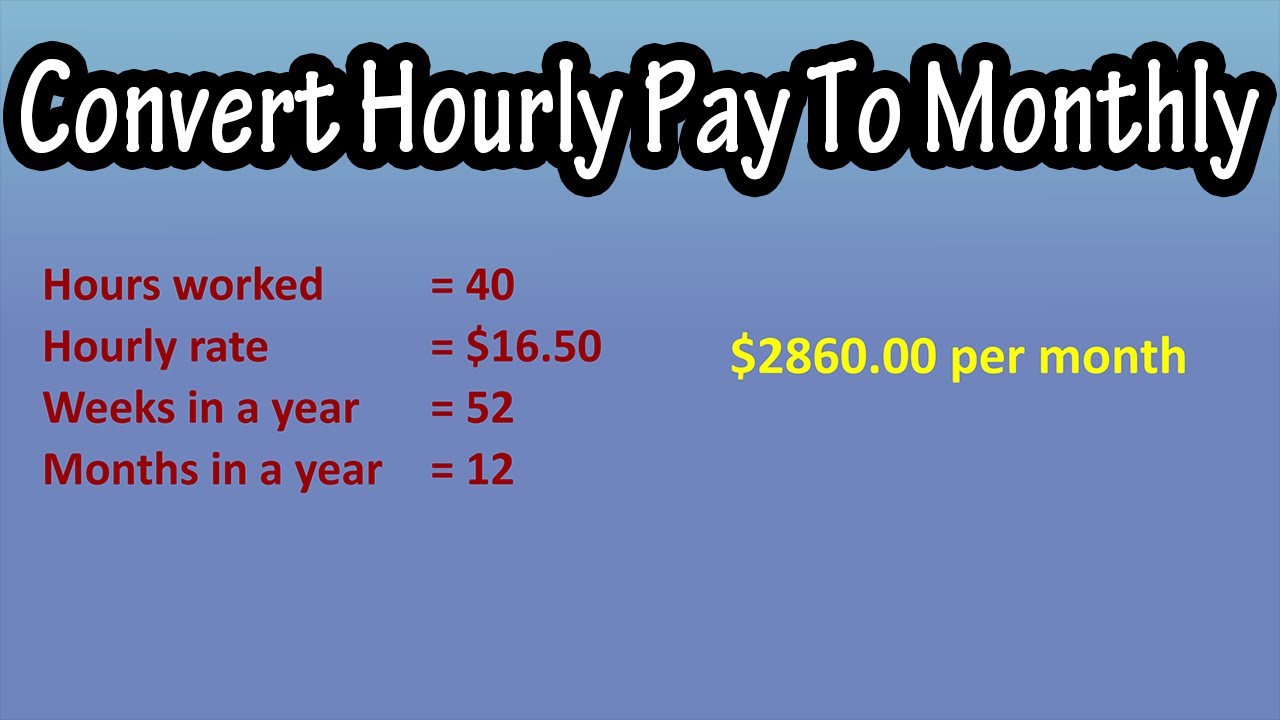

. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Use the Arkansas hourly paycheck calculator to see the impact of state personal income taxes on your paycheck. Please note this is based on a 40 hour work week with 52 weeks per year and 12 months per year.

Samantha works at a restaurant as a waitress 25 hours a week where she earns 9 per hour. Switch to Oklahoma salary calculator. Gross salary is a basic salary that an employee receives while working for an employer.

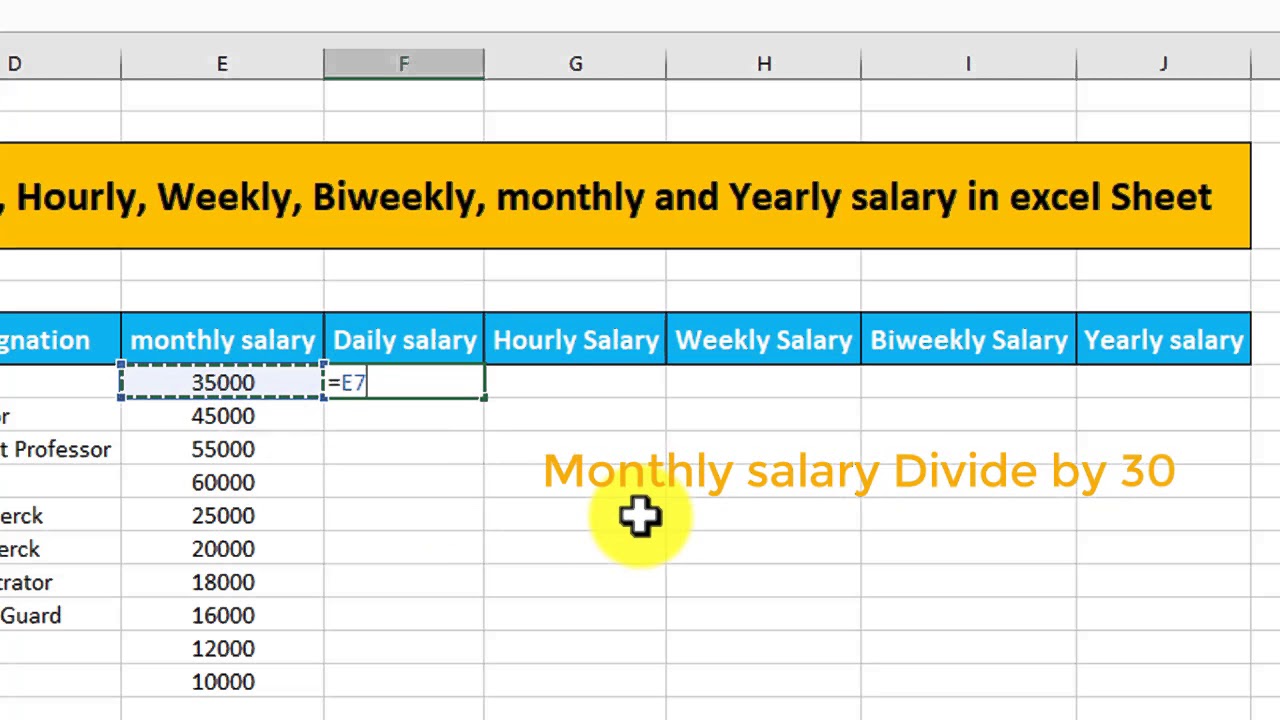

The algorithm behind this hourly paycheck calculator applies the formulas explained below. Gross and net income are two ways to measure income that are quite different. Multiply the monthly salary by the total number of months in a year which is 12.

And if youre an hourly worker your annual gross income would be what you earn per hour multiplied by the number of hours you work every year. The salary included in your employment contract will be your official gross pay. Federal Filing Status of Federal Allowances.

This Louisiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. For example if you receive. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work.

65000 After Tax Explained. Enter your info to see your take home pay. An employee who wants to make sure that he or she receives the right gross earnings on paychecks can take advantage of using an online hourly rate calculator.

Switch to Georgia salary calculator. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. You may also be able to calculate gross income based on your regular pay statements.

Adding Monthly Salary To Hourly Salary Calculator pay Calculator to your Wordpres website is fast and easy. For this example we will use a gross monthly salary of 2000 and assume you are working 40 hours per week. To forecast which will be the volume of your net income earnings at the end of the.

Any wage or salary amount calculated here is the gross income. Calculate Federal Insurance Contribution Act FICA taxes using this years Medicare. Input this income figure into the calculator and select weekly for how often you are paid to.

If you are paid hourly multiply your hourly wage by the number of hours you work per week. Determine if state income tax and local income tax apply. The 40 hour work week is 5 8 hour days.

There are six personal income tax brackets that range from 09 to 7. Payroll Deductions Calculator. Example 1 Hourly Employee Monthly Gross Income Calculations.

Review current tax brackets to calculate federal income tax. This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering Irish income tax Universal Social Charge and Pay-Related Social Insurance.

Whether the employee receives a weekly bi-weekly or monthly paycheck this calculator is simple to use. This category should equal 50 of your. Marginal Tax Calculator.

This hourly paycheck calculator helps you figure out the total gross pay or the weekly daily monthly or annual paycheck by considering hours worked pay rates. Yes there are three different personal income tax brackets. Lets calculate an example together.

The Missouri hourly paycheck calculator will show you the amount of tax that will be withheld from your paycheck. If you earn 65000 in a year you will take home 46094 leaving you with a net income of 3841 every month. Hourly Paycheck Calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Is there personal income tax in Maine. Kansas Hourly Paycheck Calculator.

Gross monthly income means your total income before any deductions. Calculating gross income for salaried employees. Yes Arkansas residents pay personal income tax.

Learn how to calculate both and why they matter in budgeting and tax prep. This British Columbia net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022. Section 125 Cafeteria Plan.

Net to Gross Paycheck Calculator. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Use our Monthly Gross Income Calculator to calculate your monthly gross income based on how frequently you are paid and your gross income per pay period.

Net salary is a portion of the Gross salary that is derived after deducting various expenses and deductions. Some people get monthly paychecks 12 per year while some. Annual Income Calculator Return.

Simply follow the steps outlined below to find your hourly rate from your monthly salary. Does Arkansas collect personal income tax. Fill the weeks and hours sections as desired to get your personnal net income.

Yes residents of Maine are subject to personal income tax. How you calculate gross income will vary depending on whether you receive a salary or hourly wage. For example if your.

Use 2020 W4. Do Kansas residents pay personal income tax. Taxable benefit paid.

Sara works an average of 37 hours per week and takes two weeks off per year. Now lets see more details about how weve gotten this monthly take-home sum of 3841 after extracting your tax and NI from. You will see the hourly wage weekly wage monthly wage and annual salary based on the amount given and its pay frequency.

Fill the weeks and hours sections as desired to get your personnal net income. Hourly rates and weekly payscales are also catered for. Switch to Louisiana salary calculator.

The latest budget information from January is used to show you exactly what you need to know. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example. This Oklahoma hourly paycheck calculator is perfect for those who are paid on an hourly basis.

In addition to her hourly wage she receives an additional 125 in tips every week on average. Yes Missouri has a progressive state personal income tax system as well as local county taxes. This is a break-down of how your after tax take-home pay is calculated on your 65000 yearly income.

These steps will leave you with the percentage of taxes deducted from your paycheck. Federal Filing Status of Federal Allowances. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Salary or wages income. Divide the sum of all taxes by your gross pay.

Net salary calculator from annual gross income in Ontario 2022 This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

Hourly To Salary Calculator Convert Hourly Wage To A Salary

Hourly To Salary What Is My Annual Income

Hourly To Annual Salary Calculator How Much Do I Make A Year

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Gross Income Per Month

Gross Income Formula Step By Step Calculations

Hourly To Salary Calculator Convert Your Wages Indeed Com

Wages And Salary Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

How To Calculate Gross Income Per Month

Hourly Salary To Monthly Paycheck Conversion Calculator

4 Ways To Calculate Annual Salary Wikihow

Pay Raise Calculator

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Hourly To Salary Calculator